Does sunshine affect the decision making of top corporate executives?

Would you feel depressed if it has rained for several days? Sunshine affects our mood. The medical sector generally believes that seasonal affective disorder (SAD) is related to shorter sunshine duration in autumn and winter, as sunlight affects the activity of the brain. A study participated by an accounting scholar from City University of Hong Kong (CityU) found that if the weather is sunny immediately before releasing an earnings forecast, firm managers tend to issue more upwardly biased forecasts. The study results provided insight into the role that transient emotional states play in shaping managerial judgment.

Professor Chen Yangyang, Acting Head of CityU’s Department of Accountancy, participated in this interesting research. The findings have been published in the academic journal The Accounting Review, titled “Emotions and Managerial Judgment: Evidence from Sunshine Exposure”.

Emotions affect people’s decisions

Instead of making well-thought-out decisions that serve the firm’s best interests, people including those decision making managers in big firms sometimes would make puzzling decisions that are affected by their mood. “Decisions made by USA public firm executives are usually consequential to their firms and could potentially affect the economy. Therefore, it is important to understand whether transient emotions affect their decision making and, if so, to what extent,” said Professor Chen.

Professor Chen further pointed out that it is well documented in psychology literature that sunshine affects the emotions of human beings. “We would like to examine whether such an effect exists in the decision making process of CEOs, who are commonly regarded as sophisticated individuals vital to the operation of a company,” he explained.

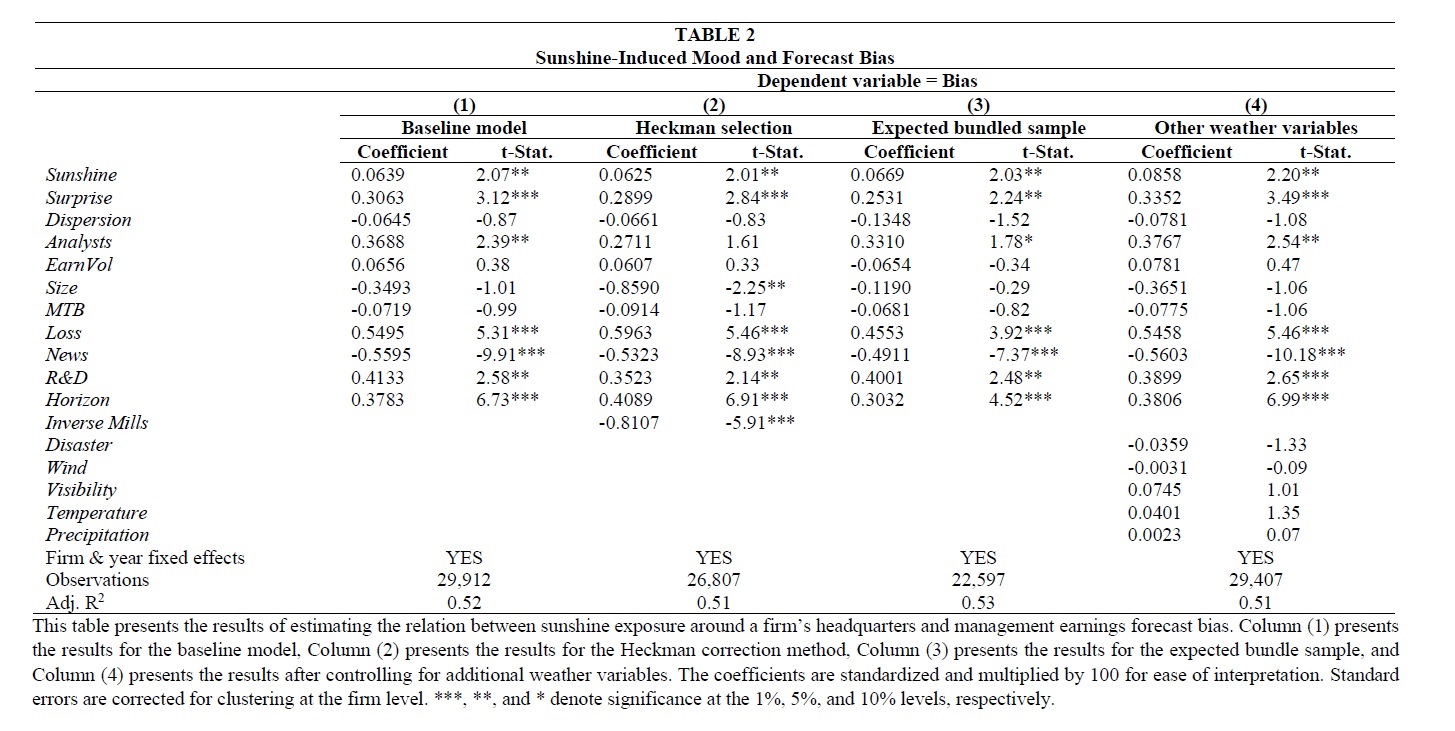

To investigate this, Professor Chen and the research team first obtained almost 30,000 sets of earnings forecast data of USA public firms from 1994 to 2010. Then they evaluated the sunshine exposure of managers based on the data from the five nearest weather stations within a 50-mile radius of those firms’ headquarters to see if the weather was sunny or cloudy around the days before the forecast was made. Finally, they tried to work out the relationship between earnings forecast made by the managers and sunshine.

This study was the first large-scale analysis on the nuanced ways in which emotions affect top executives. After analysing the data, the team discovered that managers tended to issue more upwardly biased forecasts if it were sunny days before releasing the earnings forecast. And the impact of sunshine exposure on earnings forecast bias increased when the managers were less experienced and less capable, or their firms operated in an environment with uncertain information. The team deduced that sunny days would make people feel good, which prompted the managers in making more optimistic forecasts.

The sunshine priming effect

Moreover, their data implied that managers would become less susceptible to the sunshine priming effect when their forecasts are more heavily scrutinised or when they have stronger incentives to issue accurate forecasts.

There is another interesting finding in this research. The team found that firms with managers who are more sensitive to the sunshine priming effect than their peers have a higher cost of financing. “CEOs prone to the sunshine priming effect convey biased information to the capital market, which makes it difficult for investors to make investment decisions on the firm. This increases firm information risk and raises the financing costs of that company,” explained Professor Chen.

In addition, the team found that CEOs who were more sensitive to the sunshine priming effect would “pay the price” in their career development. They experienced shorter tenure, lower pay, lesser power, and serve as CEO at fewer firms.

“In this research, we have examined the role and economic consequences of emotions in shaping the judgment of corporate executives. When developing corporate governance structures, regulators and boards may need to consider that emotions play a role in influencing the managers in disclosing information about the company. Our research also alerted investors to take into account the likely mood of the managers when interpreting their public disclosures,” concluded Professor Chen.

Apart from Professor Chen, the paper is co-authored by Professor Chen Chen of Monash University , Professor Jeffrey Pittman of Memorial University of Newfoundland and Virginia Tech, Dr Edward Podolski of Deakin University, and Professor Madhu Veeraraghavan of T A PAI Management Institute.

DOI number: 10.2139/ssrn.2973184

Newsletter Subscription: Research

Areas of Interest